Kriya CLMM Yield Optimizer Vaults are live!

Provide liquidity to CLMM (Uni-v3) via sophisticated rebalancing strategies that help boost capital efficiency and reduce IL, while auto-compounding reward and fees!

Sui Defi wave 2.0 is incoming and we’re ready. Multiple DeFi protocols have introduced a variety of yield opportunities through lending, LSDs and DEXes, and it's time to take your investment strategy to the next level.

CLMMs are exponentially more capital-efficient than traditional automated market makers (AMMs). But, passive LPing in Uni v3 DEXes (ie CLMMs) presents liquidity providers with multiple challenges:

Single-sided LP in Uni V3 pools is difficult, treasury management of both assets is needed

Requires active price range management, which can lead to capital inefficiency when volatility is high

Higher risks of realizing impermanent loss (IL)

Out-of-range positions do not earn fees & rewards

Fee and rewards need to be claimed and reinvested for it to compound

As liquidity providers navigate these hurdles, it becomes clear that a more efficient solution is necessary.

We are excited to announce the launch of Kriya's Concentrated Liquidity Market Maker (CLMM) LP Optimizer Vaults.

These vaults are designed with several key objectives in mind:

Sophisticated Active LP Management: Kriya's CLMM vaults employ advanced strategies for managing liquidity provider (LP) positions, ensuring optimal performance even in changing market conditions.

Auto-Rebalancing: The vaults automatically rebalance LP positions around the current price, which helps minimize impermanent loss and maintain an efficient allocation of assets.

Auto-Compounding Fees and Rewards: Kriya's CLMM vaults periodically compound fees and rewards, enabling users to maximize their returns through the power of compound interest.

Single-sided Sui deposits/withdrawals: Simplifies asset management and intuitive PnL tracking

By leveraging our advanced CLMM strategies, Kriya aims to boost capital efficiency for users, ensuring their assets generate optimal returns while minimizing risks associated with impermanent loss.

Users can sometimes enjoy LP yields exceeding 2X of direct LPing, amplifying their earning potential.

The Vault Strategies

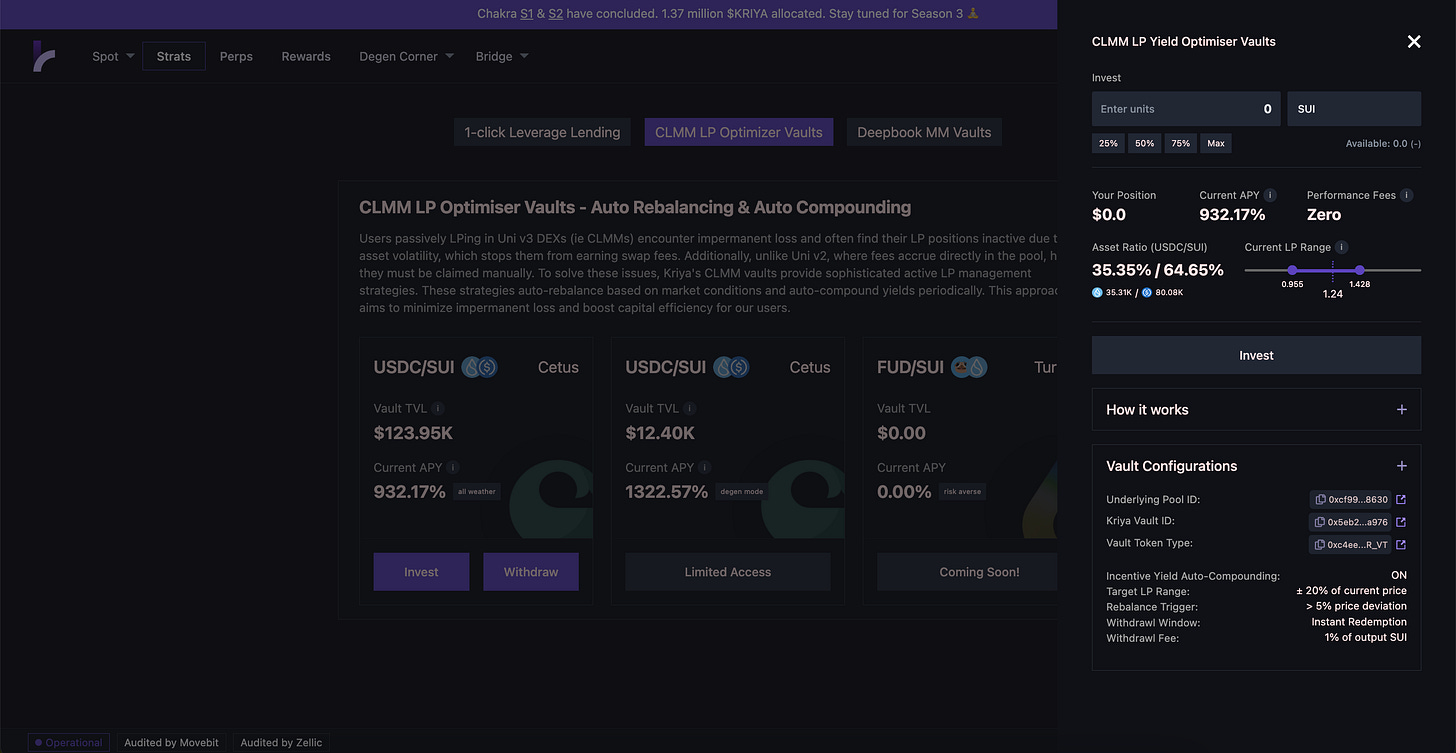

Our V1 release offers two vaults based on the Cetus liquidity pool, each catering to different investor risk profiles:

The All-Weather Vault: This vault features a 5% trigger and a ±20% rebalance range, providing a more balanced and conservative approach to LP management. Ideal for risk-averse investors seeking steady returns.

The Degen Mode Vault: With a 2% trigger and a narrower ±5% rebalance range, this vault targets higher potential returns but with increased risk. Suitable for investors with a higher risk appetite and those seeking more aggressive growth.

Here’s a glimpse of our interface:

How does the CLMM Yield Optimizer Vault work?

The user deposits SUI into the vault

Auto-Swapping for Asset Balancing: The vault's strategy automatically converts a portion of the deposited SUI to USDC; based on the current target LP provisioning range ensuring an optimal balance of assets within the liquidity pool.

Price Monitoring: The vault continuously monitors the price movements of the underlying asset pair. If the price moves beyond a predefined threshold, called the Reset Range, the vault triggers a rebalance to optimize the LP position.

Rebalancing and Target LP Range: Once the Reset Range is triggered, the vault adjusts the underlying Cetus LP position using new price ranges, called the Target LP Range. Each vault has a predefined Target LP range and Reset Range to cater to risk appetites.

Yield Conversion and Reinvestment: Periodically, the yield earned from swap fees and reward emissions is converted to SUI and reinvested into the underlying LP pool, considering the latest asset ratio. This continuous reinvestment ensures users benefit from auto-compounding, further enhancing their returns.

Here’s a short tutorial to understand how to invest in the vault:

Migrating Cetus Positions

Existing Cetus investors can easily migrate their LP positions to the CLMM Yield Optimizer vault with just one click. Simply visit the Kriya App 'Strats' page and select 'Migrate Capital in 1 click' on the vault section.

To promote long-term liquidity provision and support the Kriya team's efforts in delivering value through upcoming product launches, we will implement a 1% withdrawal fee. This fee, lower than industry standards, will contribute to the protocol treasury and is justified by our platform’s substantially higher returns.

Your support enables us to continue providing innovative DeFi solutions, so keep an eye out for exciting developments, such as Chakra Season 3 and our upcoming perps launch :D

We’ll soon launch vaults for NAVX-SUI on Cetus and FUD-SUI on Turbos. We'd love to hear your suggestions for additional pairs!

Happy Farming! 🧘♂️

For those new here, these links might help:

Dapp link: app.kriya.finance/spot/swap

For those looking to contribute and earn $KRIYA via social / community effort: Follow our Galxe and Zealy pages for new quests coming out soon

Drop in for support/farming alpha on our Discord server

Follow us on Twitter for more such announcements