Kriya 1-click Strats are live!

Farm multiple DeFi protocols in a single click, improve efficiency of your capital with leveraged strategies

Sui DeFi is thriving. From lending to LSDs to DEXs, there’s an array of opportunities - anticipated airdrops, points, $SUI emissions and much more!

But it’s not easy to navigate this ecosystem. Multiple portfolio dashboards of multiple DeFi protocols, maintaining health factors across lending apps, impermanent loss in DEX LP positions, there’s a lot to manage across a lot of venues.

The goal of Kriya’s 1-click strats is to make this easy by:

Automating complex cross-protocol workflows and reducing them to a click

Give users access to capital efficient strategies, increasing their capital utilisation

Give users access to unique routes optimised for earning points across multiple DApps

For external reference, users can think of this product similar to Instadapp on EVM or Kamino Multiply on Solana. These 1-click strats are powered by Sui’s programmable txn blocks (PTBs) which is a chain level functionality to batch execute transactions.

The Strategies 👩🌾

In v1, we’re releasing flashloan based SUI / USDC leverage lending strategies built on top of Navi and Scallop.

The concept

If I have 100 SUI, I can lend 100 SUI on a lending protocol and get some APY. Let’s say LTV allowed for the SUI pool is 75%, this implies i can borrow 75 SUI as well. Now what if I deposit this 75 SUI back in the pool, now my total supply is 175 SUI, borrowed = 75 and making my account leverage = 1.75x

leverage = supplied / (supplied - borrowed)

borrowable = ( supplied - borrowed ) * LTVNow I can borrow another 75 SUI and put it back in the lending pool resulting in total supplied = 225, total borrowed = 150 and leverage = 3x

I can do this once more, borrow 56.25 more, supply again resulting in : total supplied = 281.25, total borrowed 206.25 and leverage = 3.75x

This way I can earn yield on 281.25 SUI instead of the yield on my initial 100 SUI. I will get more airdrop points for higher lending and borrowing values as well.

Can this be done indefinitely?

Ofcourse not, there is no free lunch in finance. As we increase the number of loops, leverage increases at a slower rate and account keeps getting close to liquidation (For instance, on Navi, for the SUI pool, liquidation threshold is 80% ie 5x leverage)

Implementation via Flashloans 🏎️

Instead of actually lending and borrowing multiple times, we utilise flashloans to build the leveraged position more efficiently. Here’s how it works:

Step 0 : The math

Initial State

supplied_i = 0 SUI

borrowed_i = 0 SUI

Initial Deposit (principle_capital) = 100 SUI

target_leverage = 2.5x

We can calculate end state of the account basis these 2 equations:

supplied - borrowed = principle_capital

supplied / (supplied - borrowed) = target_leverage

End State

supplied_t = 250

borrowed_t = 150Step 1 : Take flashloan worth (supplied_t - principle_capital) ie 250-100 = 150 SUI from Scallop

Step 2 : Supply 250 SUI on Navi, borrow 150 SUI

Step 3 : Return 150 SUI flashloan to scallop at the end of the transaction

How to use the feature : UI Tutorial 📝

Head to app.kriya.finance/strategies

On day 1, we’re launching 2 Navi Maxi vaults, one fore looping SUI and other for USDC. Both vaults support implementing max 3x leverage

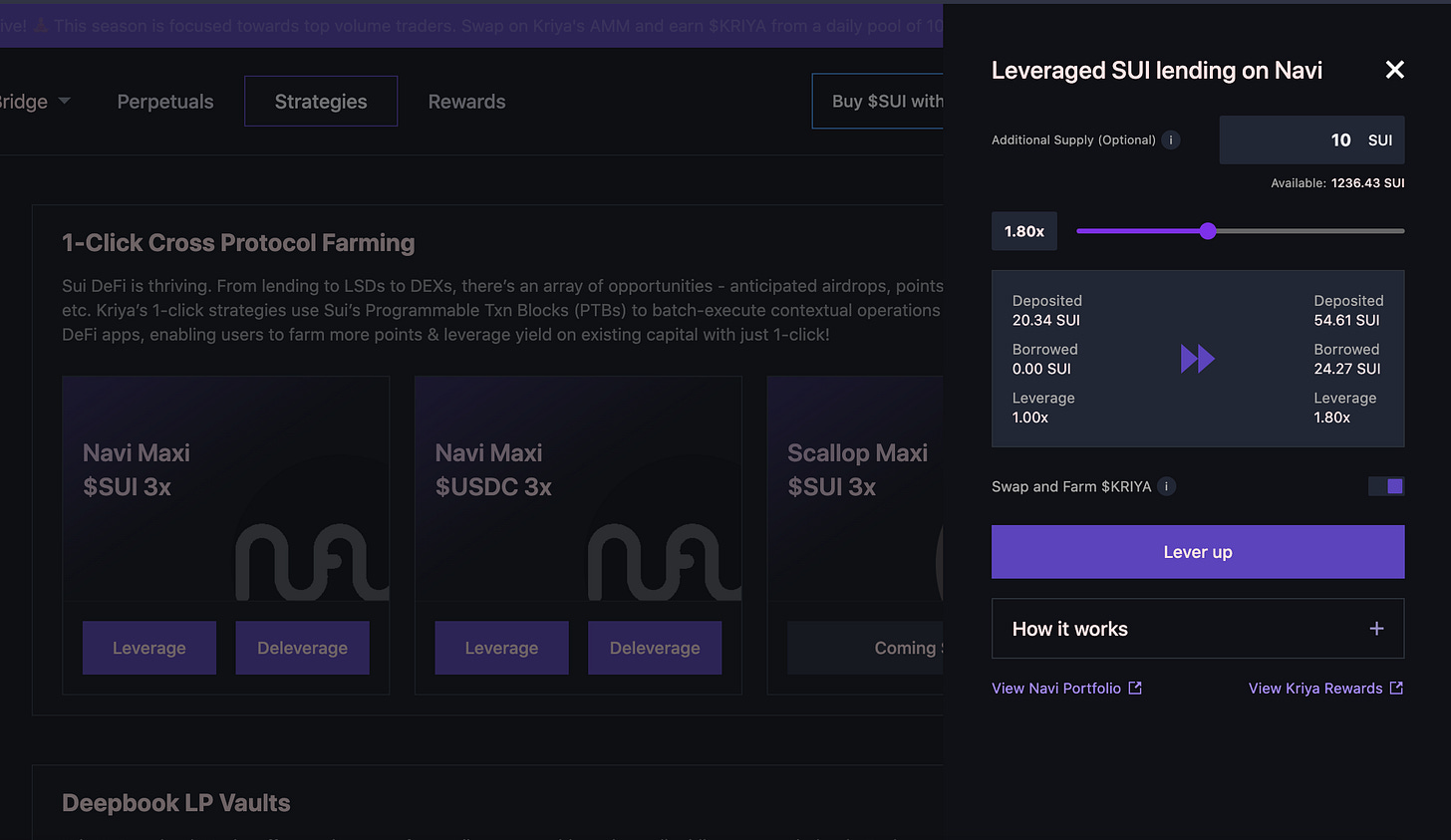

In case you want to create a position or increase the leverage of an existing position on Navi, click on the ‘Leverage’ Button

A side pane opens up, you can input initial supply amount, target leverage and that’s it you’re good to go. Make sure check your account’s initial and resultant supplied/borrowed ratio before finalising the transaction

Additionally, users can who enable the ‘Swap and Farm $KRIYA’ option will have some swaps included in their batched txn helping them earn points in Kriya’s ongoing Chakra Season 2 Campaign (Details here)

Similar to leveraging, users who already have a leveraged position can also deleverage their position back to 1x via Kriya

Below is a video tutorial for easy understanding. The users starts with no initial position, supplies 100 SUI, creates a 2.5x leveraged position, deleverages it back to 1, then leverages it again to 2x

For those new here, these links might help:

DApp link: app.kriya.finance/spot/swap

For those looking to contribute and earn $KRIYA via social / community effort: Try our Zealy Quests

Drop in for doubts / farming alpha on our discord server

Follow us on the bird app for more such announcements: twitter.com/KriyaDEX

Happy Farming! 🧘♂️