gm Kriya fam! ☀️

We know it’s been a while

But don’t worry, we aren’t Su and Kyle

We don’t click bait,

This product update is definitely worth the wait 🌊

In this month’s release, we’re happy to launch perpetual futures trading on KriyaDEX 🚀 If you head to kriya.finance now, you won’t find KriyaSwap (the Spot AMM DEX we launched in November’22), rather you’ll find a completely overhauled UI specifically meant for trading derivatives!

So, how does it work?

There are three core elements to Kriya’s trading infrastructure →

Price Discovery: Order Placement and Trade Matching

Leverage: Position Margining and Liquidations

UX: Funds/Collateral management, Fee/Rewards module

Price discovery on the KriyaDEX happens via our lightning-fast on-chain limit orderbook. Users call relevant functions of our smart contract to convey their intent to place a certain order, once these orders pass certain margin checks, they are batched together and sent to the orderbook for matching. With this granular approach, the user can verify each step of the process ie

Did the webapp convey my intent to place the order?

Did the placed order pass the margin checks? 🔍

In which exact batch did my order enter the orderbook (One can compute for themselves if their order was filled at the correct price)

All market orders within a batch are executed at the same price. This optimization helps us further reduce MEV. There are many data structure level innovations we’ve done to reduce orderbook latency as well, we’ll be releasing a tech blog on our findings soon. Once all eligible orders of a batch are matched, the orderbook updates its state and calls the settlement smart contract which accordingly adjusts assets and liabilities in the impacted user accounts.

All KriyaDEX accounts are cross-margined by default. This in simple terms means your cash collateral can be used across positions multiple positions. One can use the profits from a position to hold another loss-making position for longer, providing better capital efficiency to traders. In v1, KriyaDEX will be supporting a maximum of 20x leverage on deposited capital. This leverage cap might increase later, but we request ya’ll to still keep your stop-losses in place 🙏

User deposits are stored as Sui-wrapped shared objects. Users can withdraw any funds that aren’t being used as maintenance margin for active positions, in a completely permissionless way. All unused collateral stays in users’ self-custody.

DApp Walkthrough

Here’s a step-by-step guide representing the complete journey from depositing funds to trading perps on KriyaDEX 💹

Step 1

Make sure you have all the required setup to interact with the sui-devnet

a) Have one of these browser wallets:

https://chrome.google.com/webstore/detail/sui-wallet/opcgpfmipidbgpenhmajoajpbobppdil

https://chrome.google.com/webstore/detail/ethos-wallet/mcbigmjiafegjnnogedioegffbooigli

b) Load the wallets up with devnet SUI tokens from the wallet by clicking ‘Use faucet’ (Ethos wallet in the example)

Step 2

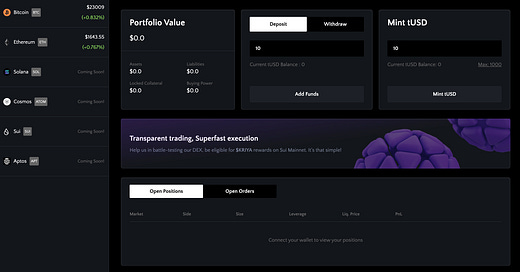

Head to kriya.finance or perp.kriya.finance to access the derivatives DEX. Click on ‘Connect wallet’ on the top right

Don’t worry, the spot AMM DEX is still live on spot.kriya.finance, will be merged with the new KriyaDEX soon 🙂

Step 3

Since this is devnet, ya’ll will need some test dollars $$$ to interact with our platform. Mint upto 1000 tUSD to your wallet using this modal on the right →

Step 4

Once your ‘Current tUSD Balance’ > 0, Deposit these tUSD funds to your Kriya Wallet. This tUSD will be used as collateral for all your positions. After a successful deposit, your Portfolio value should increase (As well as the value in the ‘Assets’ section.

Step 5

Now that we have some dry powder loaded up on Kriya, let’s start trading. Click on either ETH or BTC on the left pane. You’ll be redirected to the trading screen.

In the center you can see the price chart (for now we’ve integrated a basic version of tradingView, we’re open to more suggestions as we get closer to mainnet)

Above the chart are some metrics related to that particular asset’s market :

24h Trades, 24h % change, 24h High | Low, 24h Volume, Funding Rate (deducted every 6 hours)

On the right there are 2 modals, vertically stacked. One is the orderbook and trades feed. Other is the place order form.

Step 6

KriyaDEX supports Market and Limit order types in v1 (SL, Trailing-SL, Reduce-only coming soon!)

Once you spot the opportunity on the chart, select ‘Buy’ or ‘Sell’, enter the trade qty (Amount), your desired price, and leverage.

If you have sufficient buying power, the place order button will turn purple. Click on it to place your order, it will open your browser wallet and ask for a signature, once done, your order is sent! 🚀

Step 7

On both the dashboard and the trading page, users can see their ‘Open Orders’ and ‘Open Positions’. Open orders are placed orders that are yet to be matched with a counterparty on the orderbook, whereas open positions is the state after order matching. These are trades that are currently active. You can choose to partially or fully close them depending on your profits 🤑

So what are you waiting for?

Try out KriyaDEX today! We’ve put in a lot of hard work in getting this ready as early as we could. And we’ll be shipping more features soon 🚀

So c’mon fam! Show us some love 💝 Ask doubts, share feedback

We’ll also be hosting a bunch of giveaways and trading competitions soon! You wouldn’t want to miss these airdrop alpha opportunities! 🎁

Join our discord server, and follow us on twitter for more!

🔥 Seamless UX!

Wooooohooo lfg